McDonald's Corp. (MCD) Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structuue: Motive

Position: Wave {iii} of 1.

Direction: Upside into wave 1.

Details: Looking for a five wave move completion within wave 1 as we are now approaching TradingLevel3 at 300$.

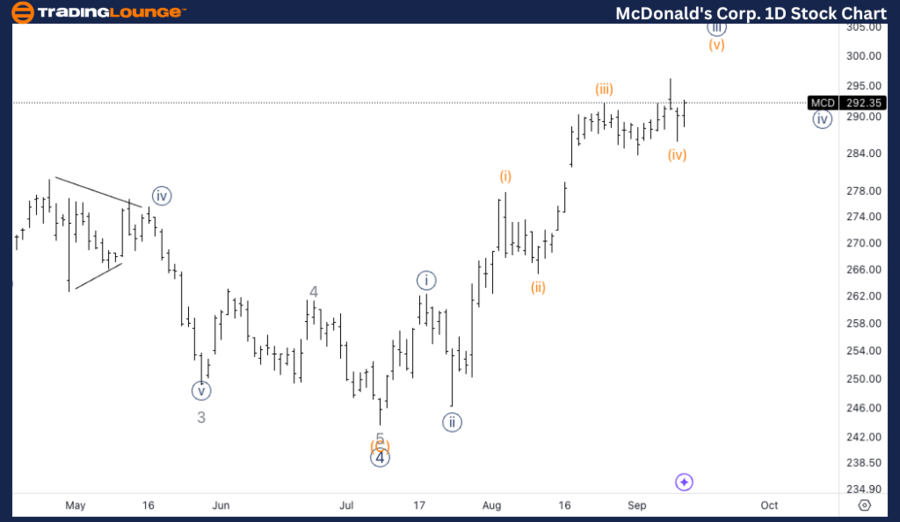

MCD Elliott Wave technical analysis – Daily chartIn the daily chart, McDonald's is showing a clear impulsive trend, currently progressing within Wave {iii} of 1. This suggests the stock is in the midst of a strong upside move. As the price approaches the critical level at $300, known as TradingLevel3 (TL3), we are looking for the completion of a five-wave move within this initial wave 1.

MCD Elliott Wave technical analysisFunction: Trend.

Mode: Impulsive.

Strucutre: Motive.

Position: Wave i of (v).

Direction: Looking for upside into wave (v).

Details: Looking for upside into wave (v) as we seem to have a flat in wave (iv) and we found support on top of the end of Minor Group 2 at 280$.

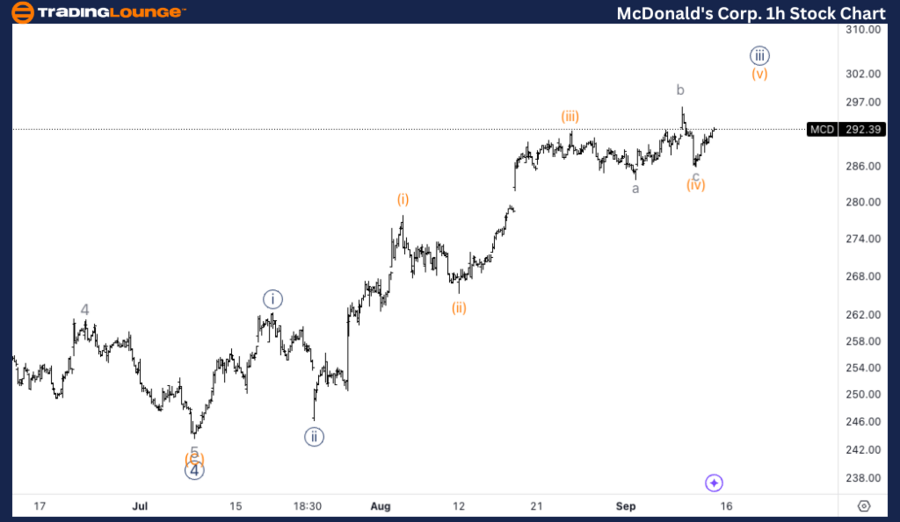

MCD Elliott Wave technical analysis – One-hour chartOn the 1-hour chart, MCD appears to be progressing within Wave i of (v), signaling that we are likely entering the final leg of the current impulsive sequence. The recent Wave (iv) formed a flat corrective structure, and the stock found key support around $280, which corresponds to the end of MinorGroup2.

In this Elliott Wave analysis of McDonald’s Corp. (MCD), we assess its current price action and wave structure using Elliott Wave Theory to help identify trading opportunities. Both the daily and 1-hour charts are examined to provide a comprehensive outlook for traders.

McDonald’s Corp. (MCD) Elliott Wave technical analysisAs with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.