Nvidia share price surges but is it overvalued? Here's what the ...

Image source: Getty Images

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More.

The Nvidia (NASDAQ:NVDA) share price could surge Thursday (24 August) when the market opens. The stock more than delivered in its Q2 results earnings after the market closed on Wednesday. Its earnings not only impacted the Nvidia share price, but stocks around the world. The company is also buying back $25bn of stock, raising some questions about reinvestment. So, let’s take a closer look at this stock.

Mic-drop momentHere’s a summary of the earnings that were described as a ‘mic-drop moment’.

Revenue jumped to $13.51bn, marking a remarkable 101% surge from the previous year. Analysts projected $11bn in revenue. Adjusted earnings per share (EPS) stood at $2.70, a huge increase of 429% compared to the previous year. EPS outperformed predictions of $2.07. Nvidia’s forward guidance for the current quarter was $16bn. That’s considerably higher than Wall Street’s $12.5bn forecast. The graphics chipmaker’s shares jumped around 9% in after-hours trading on Wednesday, reaching a record peak of $515 per share. ValuationNvidia shares are up 173% over the past 12 months, and understandably that’s had a profound impact on valuation metrics. We can observe the share price gains in the following chart.

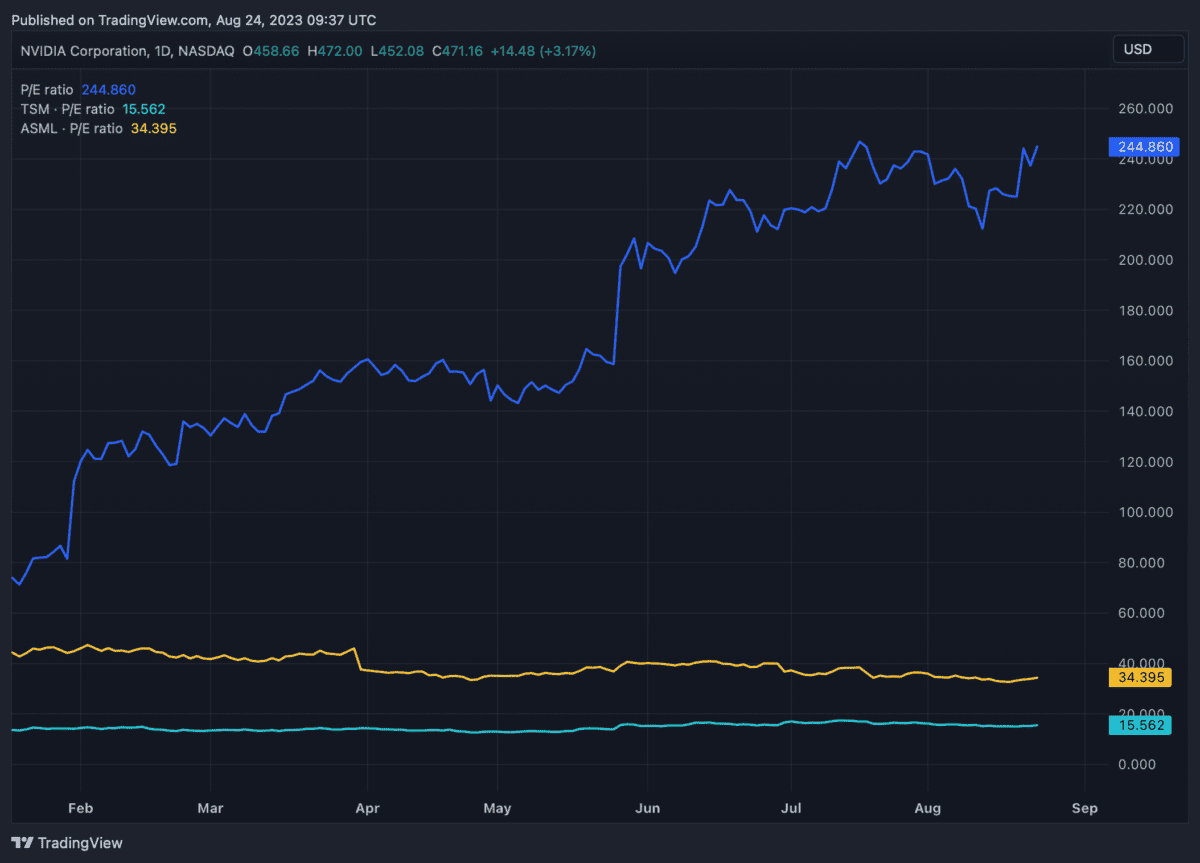

We can see that Nvidia is almost in its own league. It is among the most expensive stocks I’ve ever come across. Starting with the price-to-earnings metric, on a trailing-12-month basis, it trades at 244 times earnings.

Created at TradingViewAs we can see here, Nvidia trades at a huge premium versus peers including TSMC and ASML. Admittedly, neither company is as exposed to the AI boom as Nvidia, but it’s a useful comparison. Nvidia’s GPUs — traditionally used in the gaming sector — are the platform of choice for AI developers around the world.

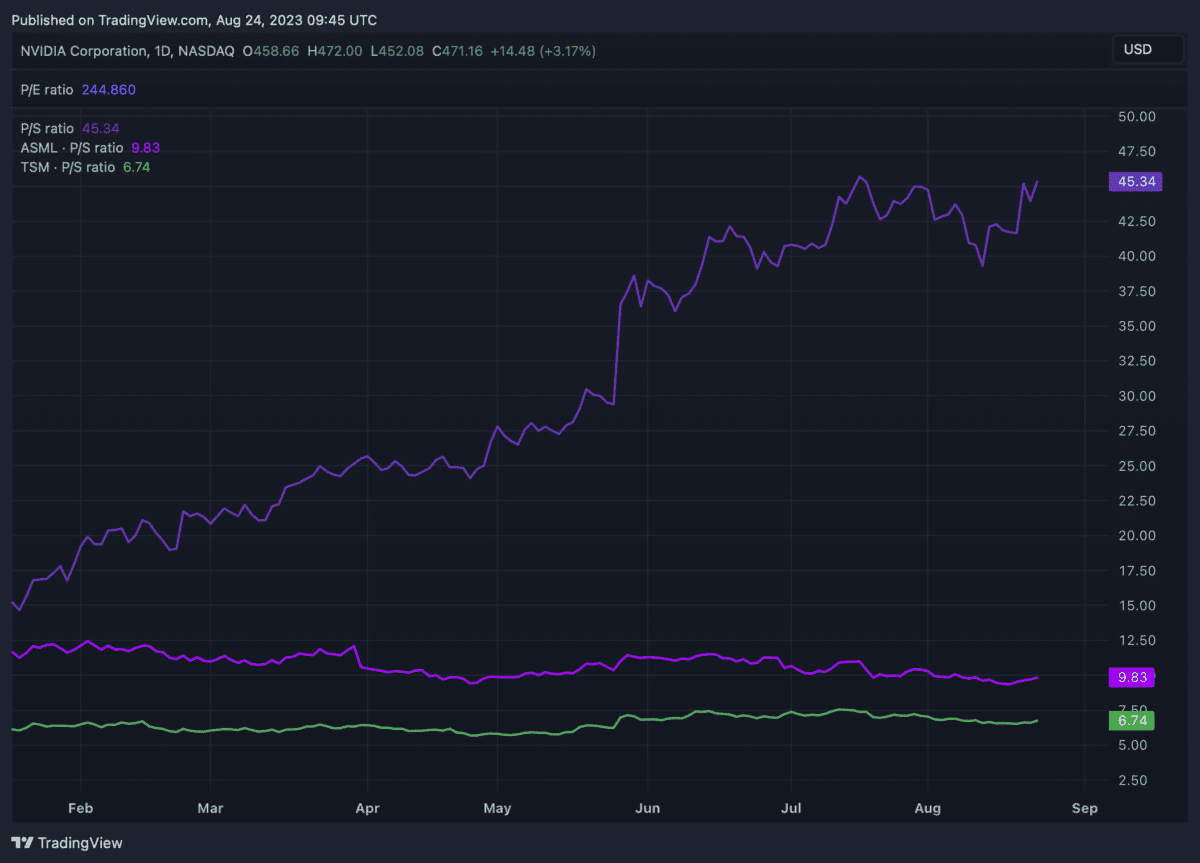

Next, using the price-to-sales metric, we can also see how expensive Nvidia appears. The stock trades at 45 times sales on a trailing-12-month basis. Normally, we’d consider a P/S ratio of 10 or above to be expensive. Clearly Nvidia is an exceptional case.

Nvidia trades at a huge premium to its peers. In fact, it’s around seven times as expensive as TSMC using this metric. Geopolitics is a major reason for the discount on the Taiwanese firm. But it’s interesting to note that TSM, like Nvidia, has a competitive advantage in its field. TSM also makes Nvidia’s chips.

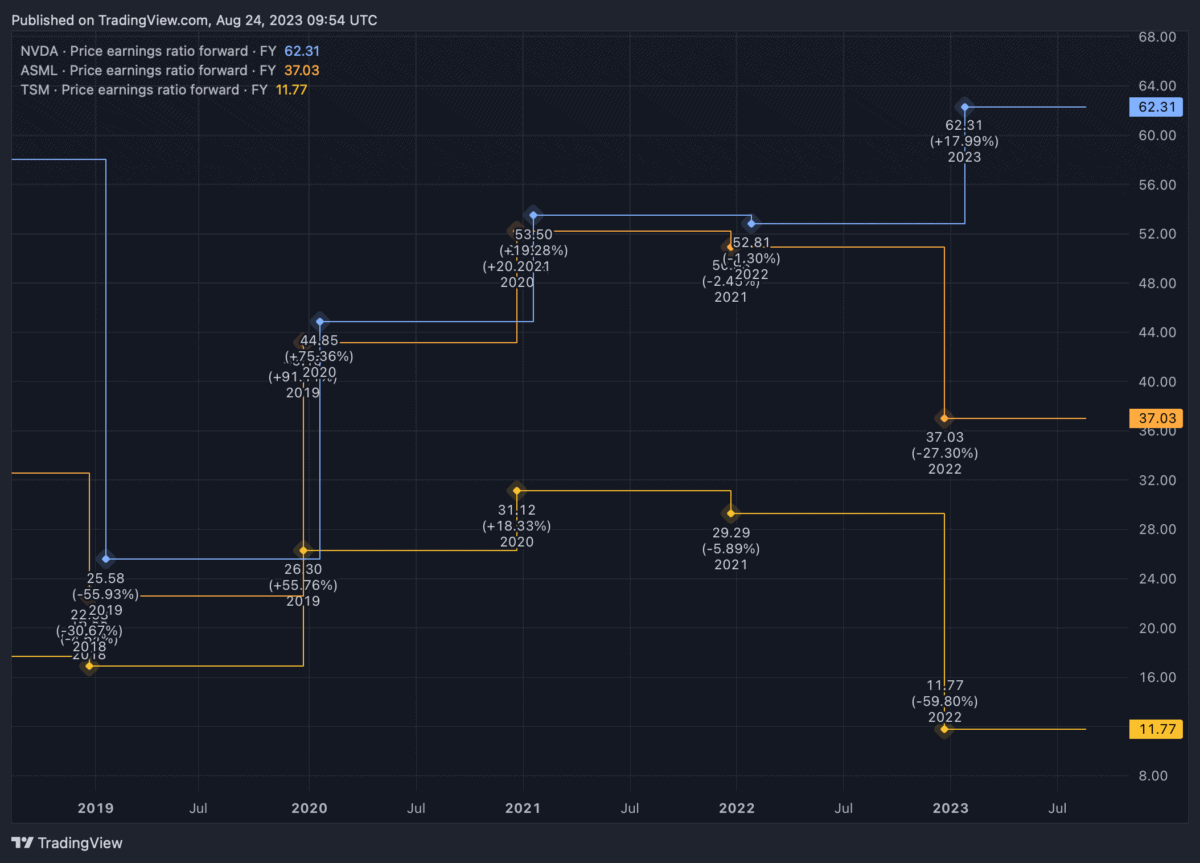

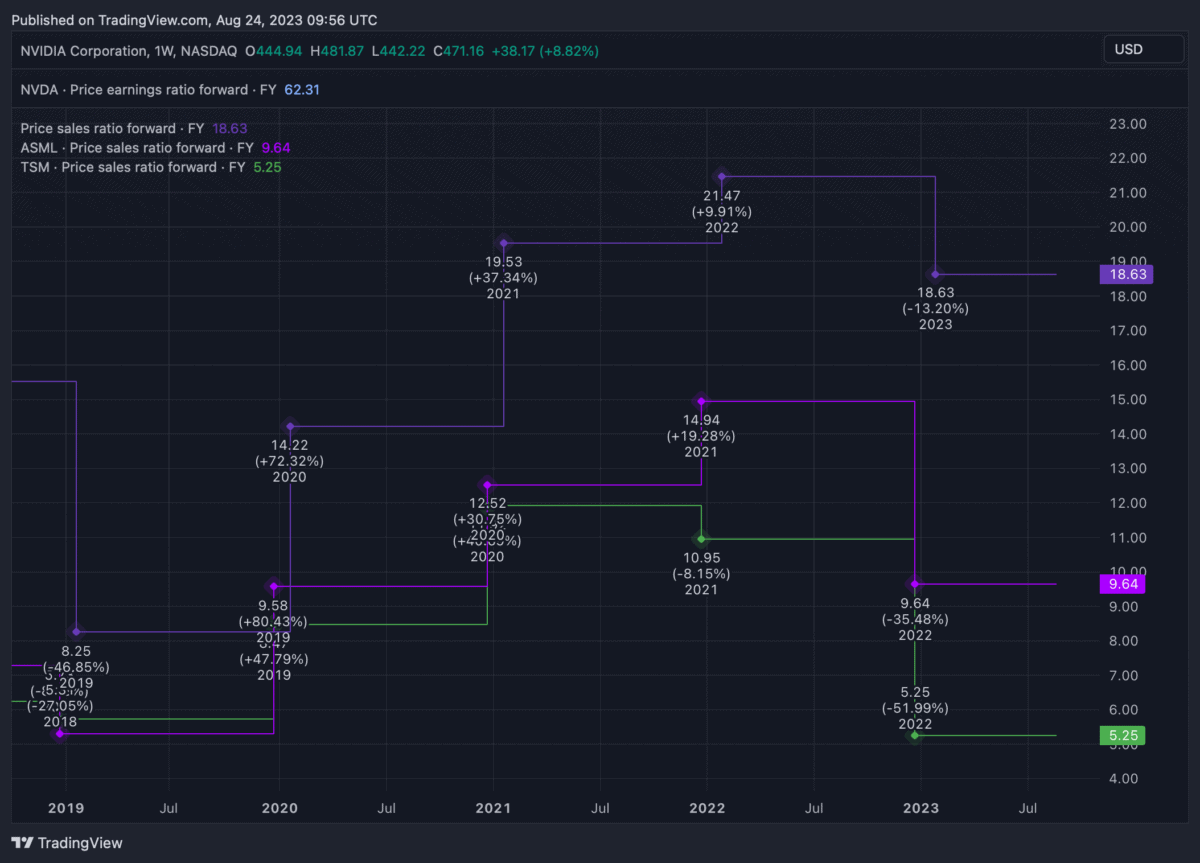

However, on a forward basis, Nvidia starts to look less expensive, although it’s clearly trading at a premium. Of course, it’s worth noting that its intrinsic value is based on its long-term potential to generate revenues on the back of a boom in AI development and usage.

Created at TradingView Created at TradingViewIn conclusion, it’s clear that Nvidia trades at a premium to the market and its peers. However, it remains unclear as to whether that valuation is truly warranted. Momentum can be a fickle things when investing. And up 173% over 12 months, there’s clearly a lot of potential for price falls.

Investing Articles The hidden downside to using investment platforms

24 August, 2023 | Malcolm Wheatley

Investment platforms have revolutionised investing, enabling millions to take the plunge. But in terms of enabling shareholder participation and monitoring,…

Read more »

Investing Articles Should I buy Harbour Energy shares for their 7.8% dividend forecast?

24 August, 2023 | Alan Oscroft

Harbour Energy shares offer a high dividend forecast, and the company is past the high debts of its early days.…

Read more »

Investing Articles Should I buy these 7 stocks due to be promoted to the FTSE 250?

24 August, 2023 | Jon Smith

Jon Smith reveals the likely contenders to be promoted next week to the FTSE 250 and mulls over what to…

Read more »

Investing Articles I’d aim to turn an empty ISA into £3,057 monthly passive income

24 August, 2023 | John Fieldsend

An empty ISA? If that was my starting point, I’d look to invest in stocks to create a superb passive…

Read more »

Investing Articles These 2 FTSE 100 heavyweights could make me £2,050 in second income!

24 August, 2023 | Simon Watkins

These FTSE 100 stocks have strong balance sheets and solid businesses. They pay stellar dividends, and could make me a…

Read more »

Growth Shares Lloyds shares to 80p? Here’s what the top bank analysts are forecasting

24 August, 2023 | Jon Smith

Jon Smith reviews the current forecast for Lloyds shares from the other major banks, including the rationale behind it.

Read more »

Investing Articles Could RC365 shares be a ‘pump and dump’?

24 August, 2023 | Edward Sheldon, CFA

RC365 shares shot up spectacularly earlier in the year but are now falling hard. Could the stock have been a…

Read more »

Dividend Shares Near 52-week lows, are Persimmon shares a good buy for income and growth?

24 August, 2023 | Edward Sheldon, CFA

Persimmon shares have been hammered over the last year. Could they provide attractive returns for long-term investors from here?

Read more »

We have taken reasonable steps to ensure that any information provided by The Motley Fool Ltd, is accurate at the time of publishing. Any opinions expressed are the opinions of the authors only. The content provided has not taken into account the particular circumstances of any specific individual or group of individuals and does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation, when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser. No liability is accepted by the author, The Motley Fool Ltd or Richdale Brokers and Financial Services Ltd for any loss or detriment experienced by any individual from any decision, whether consequent to, or in any way related to the content provided by The Motley Fool Ltd; the provision of which is an unregulated activity.

The value of stocks, shares and any dividend income may fall as well as rise and is not guaranteed, so you may get back less than you invested. You should not invest any money you cannot afford to lose, and you should not rely on any dividend income to meet your living expenses. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, administrative costs, withholding taxes and different accounting and reporting standards. They may have other tax implications, and may not provide the same, or any, regulatory protection. Exchange rate charges may adversely affect the value of shares in sterling terms, and you could lose money in sterling even if the stock price rises in the currency of origin. Any performance statistics that do not adjust for exchange rate changes are likely to result in an inaccurate portrayal of real returns for sterling-based investors.

Fool and The Motley Fool are both trading names of The Motley Fool Ltd. The Motley Fool Ltd is an appointed representative of Richdale Brokers & Financial Services Ltd who are authorised and regulated by the Financial Conduct Authority (FCA) (FRN: 422737). We publish information, opinion and commentary about consumer credit products, loans, mortgages, insurance, savings and investment products and services, including those of our affiliate partners.

The Motley Fool Ltd. Registered Office: 5 New Street Square, London EC4A 3TW. | Registered in England & Wales. Company No: 3736872. VAT Number: 188035783.

© 1998 – 2023 The Motley Fool. All rights reserved. The Motley Fool, Fool, and the Fool logo are registered trademarks of The Motley Fool Holdings Inc.