The Intangible, Interdisciplinary, And Invisible Nature Of Revenue ...

The Challenge of Getting Accountants, Investors, and Managers To Understand and Agree On the Math of Growth

It is inherently difficult to predict and forecast future revenue growth – and becoming increasingly more difficult as the nature of the digital economy and the commercial models businesses use for generating revenue growth evolve. This is what makes equity investing both risky and lucrative.

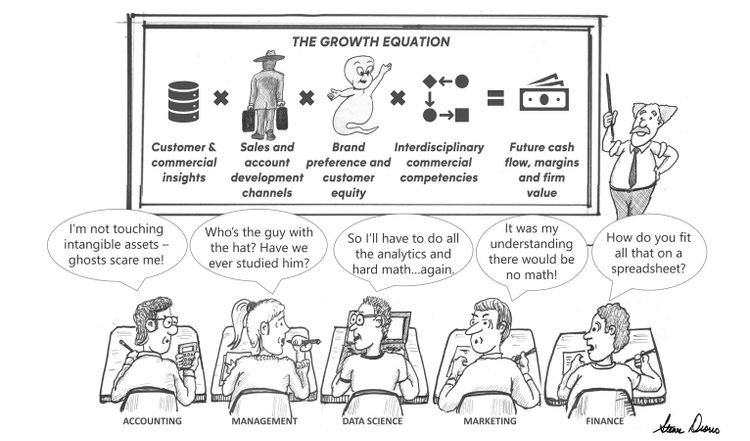

Even though organic revenue growth is the primary way firm value can grow, the “science and math of growth” are not very well understood by investors, owners, accountants, and managers. There are several good reasons for this. For starters, there’s fact that the commercial assets that generate growth in a post industrial and data driven economy are largely “intangible” - making them hard to measure, manage, and report. A second factor is the disjointed and siloed way most organizations manage their growth resources, assets and processes. This interconnected commercial model requires finance, marketing, sales, technology and customer service to share the information along the revenue cycle in order to get a clear picture of pipeline health, customer value and the long-term revenue picture. The situation will only get worse as a confluence of secular trends threatens to further erode the ability of private investors to find, evaluate, value, price and monetize their investments in privately held businesses. They include:

1. The growing role of intangible assets in firm value: The majority of the value in firms is intangible commercial assets – including market-based assets, knowledge assets, computerized information, innovative property, and economic competencies. When properly measured and account for, these intangible assets can represent up to 80% or more of the value of a business.

2. The changing nature of the commercial model: The commercial model has become more capital intensive, digital, data-driven team sport. Two thirds of growth budgets are now invested in commercial information, commercial technology, channel infrastructure and brand assets that are essential to accelerating revenues and grow firm value in the long term. Most of the buyers journey happens through a mix of 20 or more digital channels that require and create large amounts of customer information.

3. Lack of transparency in private investing: The vast majority (over 27 million) of firms are now privately held, which means they lack the financial reporting, transaction frequency and analyst scrutiny of publicly listed businesses (only 5 thousand firms are publicly listed in US markets).

4. A greater emphasis on recurring and expansion revenues in valuation. Most business-to-business firms rely more heavily on using subscription, platform, cross sell and “as a service” models where recurring revenue and customer expansion via cross selling platforms the basis of their value. This raises the bar for the quality of revenue growth (e.g. the Rule of 40) required to IPO or exit at a high multiple has increased.

All this means that the traditional tools investors and managers use to assess the ability of a business to generate revenues and hit its targets in the future – revenue forecasts, financial analysis, and customer intelligence – will increasingly fail to provide a complete or reliable picture because they miss the intangible and interdisciplinary nature of revenue growth. Conventional approaches to forecasting, recognizing, and realizing future revenues are fragmented and flawed. Traditional financial diligence tools like a Quality of Earnings analysis can miss up to three quarters of the future earnings picture because they only look at historically based financial statements.

This inability to reliably assess the future revenue generating ability of a business has consequences. It will add risk and costs while depressing the return on invested capital. It will impair the ability of investors and owners to effectively evaluate the potential of a firm to generate future revenue, margin, and cash flows. And it will confound the ability of boards and leadership teams to perform their fiduciary duty to properly value, protect, and grow the value of the firms they acquire and govern.

A core issue is the invisible nature of the drivers of growth. This stems from the fact that most of the value of, or derived from, intangible commercial assets like brand preference, customer relationship equity, digital channel infrastructure, and customer insights that do not show up in financial, management and operational reporting. This is a problem for investors because these commercial assets so fundamental to generating future revenue and margin growth are hard to measure, manage, and report because they are largely “intangible”. Similarly common sense factors like organizational information sharing, customer experience, and the quality of products, people and innovations that have been empirically proven to drive increases in firm value by academic research. But they cannot be found in the financial, management and operational reports financial analysts use as the basis of their valuation research and investment due diligence efforts. None of these important revenue drivers are typically assessed in financial reporting or a Quality of Earnings analysis. The accounting problem is these business assets that support growth are inherently “intangible” whereas factories, inventory materials, and trucks reported in financial statements are tangible. The Financial Accounting Standards Board (FASB) doesn’t require management teams to report the value of the “intangible assets” that are so important to generating sustainable and consistent margins and revenues – despite the fact they now comprise the majority of firm value, depending on the business model according to research in the book Capitalism Without Capital. In addition, investments in critical assets such as digital selling infrastructure, customer databases and brand are booked as expenses under managerial accounting principles. So instead of being managed and measured as an asset, they are viewed as a cost – and one that can easily be cut without consequences to the long term cash flow of the business. "The original sin of accounting for marketing is that all marketing investments are immediately expensed," says Professor Neil Bendle, co-author of Marketing Metrics: The Definitive Guide to Measuring Marketing Performance.70 This makes it extremely difficult for financial analysis to effectively and accurately to value and assess the growth assets and potential within a business.

Evaluating the future growth and value of a business need not be such a mystery, according to Dr. Alexander Edeling, Associate Professor of Marketing at KU Leuven. A wave of academic and commercial on the marketing-finance interface will be presented by a group of forward thinking academics who are hosting the 8th annual Marketing Strategy Meets Wall Street Conference being hosted by Edeling and Professor Marc Fischer from the University of Cologne. “Private investors and managers need to understand just how much has been accomplished within the marketing-finance interface within the past 20 years, and how important this research and knowledge is for practitioners to better evaluate their growth investments and actions,” says Dr. Edeling.

The key is to get accountants, investors, and managers to understand the science of growth and agree on the math of growth, according to Dominique M. Hanssens, Professor of Marketing at the UCLA Anderson School of Management “Three audiences – the marketing, finance and accounting disciplines - need to agree on a common math, vocabulary, and knowledge base if they are to gain a greater understanding of the variables that drive future cash flows, valuations, and firm performance in a modern economy,” says Hanssens, who is also organizing the Marketing Meets Wall Street forum. “The same is true in academia, where we have historically taught marketing, finance and accounting disciplines in a siloed fashion and published research mainly in their own discipline journals within those disciplines.” Professor David Reibstein of the Wharton School of Business and a fellow conference organizer echoes this last sentiment. “One of the root causes of this problem is that historically academic and business institutions have taught and managed the science of growth as a set of individual disciplines – branding, product management, marketing and analytics,” says Reibstein in the book Revenue Operations. “But the real-world problem of growing a business is interdisciplinary in nature. We as teachers need to do a better job of creating skills, structures, and leaders who can manage, coordinate, and align all these disciplines coherently around the customer. Being the captain that coordinates and leads all those functions in a business is a very big job. But an essential one.”

The Marketing Meets Wall Street forum seeks to start to bridge this knowledge gap by bringing academics, investors, and practitioners together to share the latest research on the marketing -finance interface. The goal is to create a common understanding of the intangible, interdisciplinary, and invisible nature of evaluating and predicting the future revenue generating potential of a business. They will be sharing research into the marketing-finance interface proves the value and contribution of market-based intangible assets – including the brand, customer equity and perceptions of quality and innovation – to future cash flows, revenues and margins, and ultimately the value of the enterprise. For example, Professor Edeling and Marc Fisher conducted a meta-analysis of 488 elasticities drawn from 83 studies to develop econometric elasticity estimates of the stock market impact of marketing actions and marketing assets. The research revealed that customer based assets – such as brand equity, customer equity - had a material impact on future cash flow. For example, the research found that a10% increase in brand related assets (such as brand equity) will drive a 3.3% increase in firm value (or stock price). Customer equity had an even larger impact on firm value and financial performance.

A parallel analysis by Hanssens, and Professor Shuba Srivinasan of the BU Questrom School of Business, entitled Marketing and Firm Value, Foundations and Trends in Marketing found that marketing-based assets like these had a much larger impact on firm value and financial performance than the marketing actions (e.g. pricing, new product launch, advertising) that many financial analysts pay greater attention to. While the meta-analysis is not perfect (e.g. it does not fully control for certain variables like the type of firm value metric used) the growing body of knowledge on the marketing-finance interface goes a long way towards validating the causal relationship between customer-based assets and firm value.

An analysis by Slate Point Partners that evaluated hundreds of academic research studies conducted over the last 20 years and a growing body of commercial research to create a holistic model that attempts to capture and measure all of the variables the have been proven to be causal of future cash flow, revenues, margins and consequently firm valuation. Put another way, the model evaluates how well an automobile can get you from point A to point B, rather than assessing just the quality and performance of the individual parts (e.g. a carburetor, engine block, transmission or suspension). “A four hundred horsepower engine by itself will get you precisely nowhere unless it is connected to a chassis, transmission and wheels,” says Steven Busby, the Founder of Slate Point Partners who helped develop the Quality of Revenue Operations model. “Investors, accountants and managers need to start looking at the whole commercial capability of a business, and not just the specific aspects they can, or choose to, measure in their due diligence efforts.”

The meta-analysis by Slate Point Partners - entitled the the Quality of Revenue Operations - identified sixteen operational value levers in the business that are proven to be causal of firm value by impacting customer decisions in ways that improve cash flow, margins, and customer lifetime value.

THE CONTRIBUTION OF THE TWELVE QUALITY OF REVENUE OPERATIONS GROWTH LEVERS TO FIRM VALUE RELATIVE ... [+] TO THE ABILITY OF MANAGERS AND INVESTORS TO ASSESS THEM IN FINANCIAL, MANAGEMENT AND OPERATIONAL REPORTING

Slate Point PartnersSix of the variables are what Edeling and Hanssens describe at intangible assets. These include brands (which represent over 10% of the value of the average business), customer equity (which can represent 15% of firm value) as well as customer perceptions of product quality and innovation, and the digital channels and data infrastructure within a business. It turns out the contribution of these “intangible assets” has long been proven through academic research, even though the accounting community will not properly capitalize them in income statements or recognize them on the balance sheet. Likewise, investors do make a big effort to evaluate and quantify these large financial assets in due diligence. And managers will espouse things like brand equity or customer loyalty as part of their strategic focus and firm values, while at the same time failing to manage these assets with fiscal discipline they apply to their factories, supply chains or investible securities.

Eight of the variables identified represent interdisciplinary competencies that connected the dots across the teams, resources, systems, and data from across the business in ways that grow customer lifetime value, improve the customer experience, and enhanced the returns on growth investments, actions, and efforts. Several of these interdisciplinary variables address the need to align customer facing functions (marketing, sales, customer success) around the customer journey, the revenue cycle and large customer relationships. Others addressed the management of cross functional processes and the sharing of information across them. For example, organizational knowledge sharing was demonstrated to have a very large impact on future revenues and commercial performance but was very difficult to measure and quantify with conventional financial, managerial and operational accounting approaches. The growing importance of interdisciplinary commercial competencies is reflected in the fact that over ninety percent of executives interviewed for the book Revenue Operations are combining marketing, sales and customer success functions and aligning the management of commercial operations, technology, information, and IP assets around the customer journey.

There is still more work to be done in quantifying all of the factors, particularly foundational things like culture and the reliability of commercial resources in creating business outcomes. “No experienced executive will argue with the notion that culture is as important or more important as strategy in practice when it comes to executing a growth strategy,” says Busby, the study’s co-author. “But the body of academic and commercial research has not armed them with benchmarks, knowledge and metrics to objectively quantify, measure and improve the growth culture and customer centricity of an organization in a more disciplined way.”